Trillion Dollar Bet (2000)

Do you want a solid background to the Black-Scholes option pricing model? Watch the documentary about the formula and the story about Long Term Capital Management (LCTM). In 1994, John Meriwether, the former vice-chairman and head of bond trading at Salomon Brothers founded Long Term Capital Management. The idea behind LTCM was to set up a hedge fund directly and actively managed by the best professional figures in academia and industry – a sort of financial dream team. To do so, Meriwether recruited both Scholes and Merton as Board Members, along with professional traders and economists…

Notes on Trillion Dollar Bet (2000)

Written by Dmytro Stoyko and Michael Bondegård1. The idea

In 1994, John Meriwether, the former vice-chairman and head of bond trading at Salomon Brothers founded Long Term Capital Management (LCTM). The idea behind LTCM was to set up a hedge fund directly and actively managed by the best professional figures in academia and industry – a sort of financial dream team. To do so, Meriwether recruited both Scholes and Merton as Board Members, along with professional traders and economists.

2. Growth

LCTM was an immediate success. Despite the tough barrier to entry for the inflow of capital (initial investment of at least 10 million USD and no redemption possible for the first three years), LTCM managed to raise 3 billion USD. Its trading strategy was kept secret but we now know it to be rather straightforward: to bet on relationships between asset prices returning to their historical level. Importantly, dynamic hedging played a crucial role in this strategy, as it gives the illusion of lowering the strategies’ overall risk and thus opened the way for extremely high leverage.

3. Crisis

The normal functioning of the markets in the mid-1990s allowed LCTM to collect great returns. Prints ranging from 25 % to 45 % of annual return on capital characterized the first years of the firm’s existence. However, normally functioning markets did not last long and in 1997 the Asian financial crisis came along, followed by the sudden and unexpected Russian default on public debt in August 1998.

During financial crises, it is common that the return on cash is higher than the return on any other asset. This typically leads to a liquidity crunch. As “cash is king”, everybody attempts to seek refuge in cash and sudden movement of this type may leave the financial markets liquidity scarce and dry. In turn, diversification may stop to work completely, in the exact moment in which it is needed the most. How does this affect the type of trading strategies à la LCTM? The scarcity of liquidity and the marked negative market sentiment which typically characterize this type of dynamics, prevent the markets from returning to historical prices. Desperately attempting to bet on this type of strategy quickly depletes capital. This was the case for LCTM.

4. The end

We know that LCTM most likely assumed financial assets’ returns to be Normally distributed. Thus, in the eye of the LCTM’s staff, the maximum daily drawdowns that the firm could be facing were in the order of a few dozens of millions USD, even during a financial crisis. Both the Asian financial crisis, as well as the Russian default, proved once again that financial asset’s returns were not normally distributed. This turned out to be a costly mistake for LCTM, which in contrast to its expectations, saw daily losses ranging in the hundreds of millions of USD dollars.

The desperate move by the firm to give back capital to its investors while keeping its positions unchanged further increased its leverage and its losses. In 1998, the cumulative losses became intolerable and the hedge fund’s meltdown started to represent a threat to the stability of the financial system. This prompted policy makers at the American Federal Reserve to intervene by creating a consortium of private firms and banks which would bail LCTM out. LCTM was eventually bailed out and closed its activities in 1999.

The LCTM saga is deeply connected to the Black-Scholes-Merton formula. Both the formula and the hedge fund made use of the dangerous assumption of Normally distributed returns of financial assets. However, empirical evidence clearly shows that non-Normal series of returns are observable in virtually any financial asset. Assuming Normality of returns often leads to an underestimation of risk, overestimation of benefits of diversification, which in turns classically leads to too much leverage.

Further reading

More articles on the same topic

The History Of Options Contracts

The anecdotal evidence about financial tools resembling options can be traced back to at least 580 B.C.

Watch Trillion Dollar Bet (2000)

Watch the documentary on the Black-Scholes option pricing.

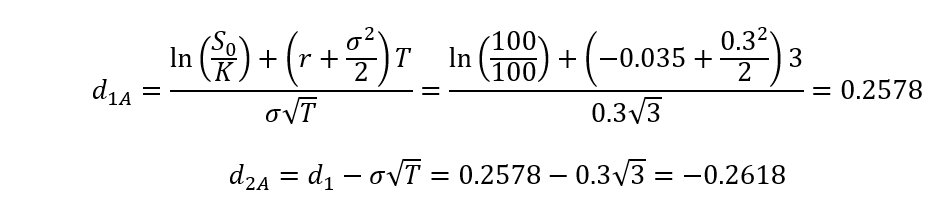

Black-Scholes formula with example

The Anatomy of the Black-Scholes-Merton formula.

Test our Black & Scholes calculator

We created a fun and educational Black & Scholes calculator for you to use for free!

17 Equations that Changed the World

From Newton's Law of Gravity to the Black-Scholes model used by bankers to predict the markets, equations, are everywhere - and they are fundamental to everyday life.