About us

Over the past two decades, we have documented and valued options on structured products, as well as on ordinary shares and fund units. A large part of the business has been involved in the design of option programs in developing companies, especially in the IT and medical technology industry, but there have been many others as well.

We are an independent valuator with a strong focus on incentive programs.

We may help you to attract and keep key people in your Company, both in a regional as well as global context. A remuneration package can consist of both cash-based compensation and other types of compensation, such as options and share awards. We at Optionspartner focus on other compensation setups, typically a sort of “shared-based-compensation” deal.

We do:

- Valuation of Options, Share Awards, Rights

- Valuation Enterprise Value, Common Stock

- Incentive program documentation

- Provide expert opinions

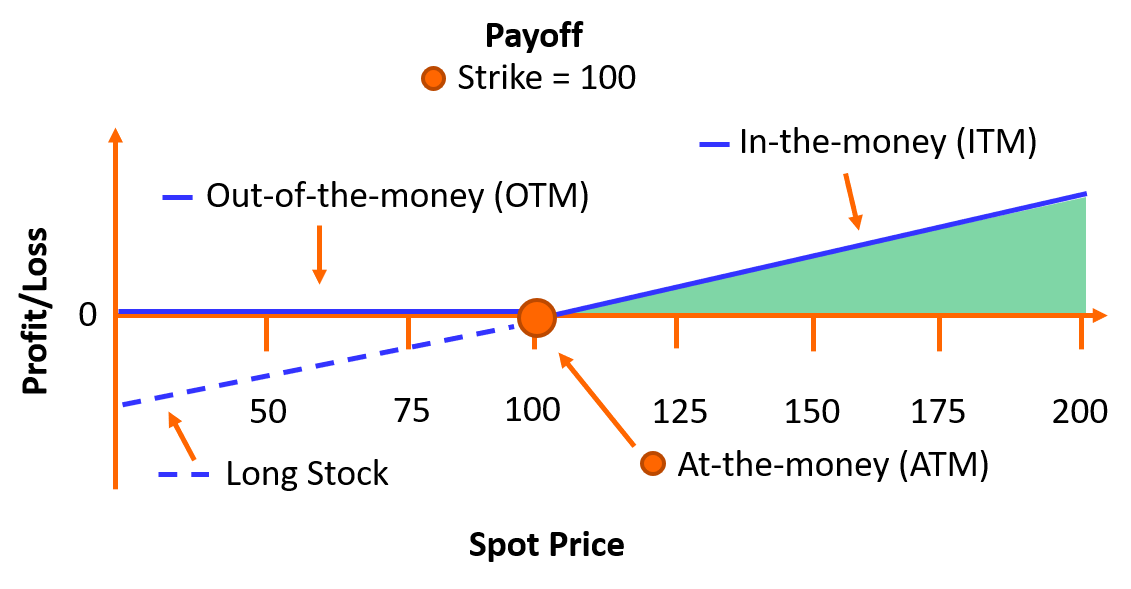

This graph illustrates the pay-off of a call option. The most attractive feature of a call option lies in its combination of an unlimited upside and limited downside!

History

We tell our story!Over the past decade, we have documented and valued options on both structured products and ordinary shares and fund units. A large part of the business has been involved in the design of option programs in development companies, especially in the IT and medical technology industry, but there have been many others as well. Michael Bondegård is specialized in derivatives, accounting and option law. He is now the CEO of Optionspartner AB. He works primarily with Option plans and valuation of financial securities. The former CEO Erik Norrman have retired. Erik Co-founded Optionspartner in 2010 after having been occupied in SkatteGruppen AB since 1981.